HWPH Historisches Wertpapierhaus AG has something to celebrate ! The company conducts its 50th auction anniversary on Saturday 15 September, a week from today. Over 900 lots of bonds and shares will then go on the block at public auction. And more than 1,200 lots are offered in the accompanying online auction ending 2 PM Monday 17 September. Here is a quick tour.

The Asia and the Middle-East section starts the ball rolling in both sales. Here are a few observations. Issued in Shanghai, 1939, a share from the Russian-Chinese Credit Society, L(ot) 685, extremely rare, starts at €2,500. The Holy Land is well represented with certificates like The Palestine Corporation Limited, 1949, L973. A share from The Palestine Land Development Company dates from as early as 1909, L974. The Japanese Meigo Steel Corporation and Naigai Steel Corporation may be acquired from €1. From Turkey, there is the Drumm Collection, historic in Scripophily, but more about that see there.

The Premier Automobiles Ltd., India

Lot 977 in the auction, the share is signed by the industrialist, philanthropist and cricketer Lalchand Hirachand as Director, and starts at €120.

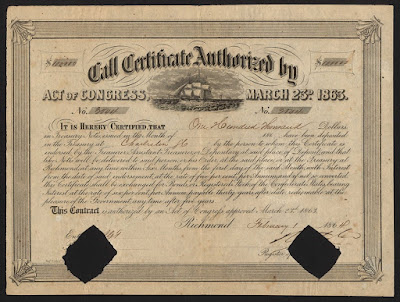

Almost 300 lots represent The Americas. An early Puerto-Rican share, L23, Compañia del Vapor de Catañio starts at €130. From New Orleans, a 1840 Mexican Gulf Rail-Way Company bond, L37, invites bidding from €450. Nearly 50 Confederate States of America are offered in both auctions. The advanced CSA expert will recognize the CSA 8% Montgomery, 1861, $500 and $1000 bonds, L24 & L25, vignettes of J. C. Calhoun and J. Davis, respectively. Lot range 48-52 is all about Thomas Alva Edison scripophily, including signatures.

William Steinway, who made the Steinway & Sons piano company world famous, developed his own company town Steinway Village in Astoria, New York. This is the serial number 1 share from the Astoria Electrical Manufacturing Company, issued to its Director William Steinway, 1891. The company manufactured electrical motors. Lot 18 in the auction, €150 start price.

HWPH, known for its Russian offerings, included this time nearly 250 lots from Russia and the former USSR. Formed in London, the New Central Siberia Ltd, L703, was active in gold mining around Yeniseysk. From Saratov, a rare 1000 Roubel bond from 1898, L782, is set at €1,600. Vignettes of a tramcar, a map of the region and a dynamo illustrate an extremely rare share from the Donbass Electric Company, L691.

A great example of Soviet artistic design, click the image to enlarge. This lottery bond was part of an internal loan issued for Stalin's second five-year plan, 1933. Lot 888, in the auction, may be bought from €100.

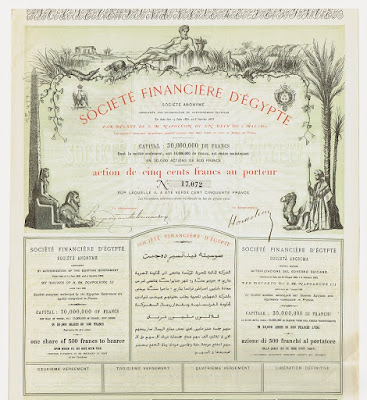

Excluding Russian and German material, HWPH included over 500

European lots, representing nearly every country. Here are some interesting items. You'll find their chocolate in almost any airport, from Switzerland, €70 can buy you a

Chocolat Tobler share, L1020. Art Nouveau and Art Deco artists created wonderful angels on these beauties :

Banco Regional de Cataluña, L69,

La Protectrice, L99 and

Exposition Religieuse Internationale de 1900, L120. The sales

50 Highlights section includes a spectacular share from

The Baltic Salvage Association. What words can not describe, a high quality image reveals in detail. So

here is a link.

Zoo collectors will love seeing these : Thiergarten-Gesellschaft in Wien, L155, Actien-Verein des zoologischen Gartens zu Berlin, L333 , Neue Zoologische Gesellschaft, Frankfurt, L457, Société Royale de Zoologie d'Anvers, L1333 and my personal favorite, Koninklijk Zoologisch Genootschap Natura Artis Magistra, Amsterdam, L669.

Koninklijk Zoologisch Genootschap Natura Artis Magistra,

500 Gulden share, unissued, 1853, Amsterdam

Natura Artis Magistra, or "Nature is the teacher of the arts", is one the oldest zoos built on mainland Europe. The zoo had three gates with the words 'Natura', 'Artis' and 'Magistra'. The Artis gate was the main one, and that's how the zoo is usually called. Only a handful of certificates like this one, L669, are known. Bids are invited from €2,000.

Over 900 German lots are spread over several sections in both auctions :

- 16th - 18th century

- Germany pre 1948

- German currency history

- Deutsch Mark (DM) certificates

- Southern Germany

- 50 Highlights

From the pre 1948 section, I noted Stadt Magdeburg 8% 100,000 Mark bond, 1923, text in German and, unusual, also in English, with striking colors and great harbour vignette, L1667.

Some German bonds and shares have survived several currency periods. During their circulation these certificates have received several currency conversion stamps, and therefore form an interesting collecting theme 'German currency history'. The William Janssen AG share, L1722, lived through four currency periods : issued in Mark, stamped consecutively in Gold Mark and Reichsmark and was still negotiable in the early DM period.

The DM section contains several early computer manufacturers : Anker-Werke, L1731, Nixdorf Computer, L602, Walther Electronic, L1856, and Siemens, L304.

The auctioneer produced a dedicated catalogue for The 50 Highlights section with extra large images and background information. Among the German lots, you'll find a collection of 192 Hamburg city related loans, some of them from the 18th and even the 17th century, L653. Historic is a J. W. von Goethe share from 1793, see the following image.

Johann Wolfgang von Goethe signed this Ilmenauer Kupfer- und Silber Bergwerk share, issued in 1793. Goethe, mainly known as a poet, novelist, playwright (Faust), philosopher, diplomat and politician, was also a mineralogist. The mineral goethite (iron oxide) is named after him. One of highlights in Matthias Schmitt's 50th auction, lot 650, it is expected to realize €20,000.

Of course, there is much more to tell, but the best way is to see for yourself. Here are the auction details :

- dates & locations

- HWPH Auction 50 (lots 1-912): 15 September 2018, Würzburg, including Award Journalistenpreis Historische Wertpapiere und Finanzgeschichte around 3 PM as part of the auction event

- Ersten Deutschen Historic-Actien-Club e.V (EDHAC) members meeting: 16 September, same location of the public auction, Würzburg

- HWPH Auction 51 (lots 913-2180): 17 September, Internet only

- More info

F.L.