Do you prefer Beauty or are you more satisfied with A Good Bargain? When it comes to collecting what do you prefer?

On the occasion of this blog's 10th anniversary, I launched in May 2020 an online poll about five collecting motives :

- Scarcity

- Beauty

- A Good Bargain

- Collection Completeness

- and Historical Significance.

These resulted in ten possible combinations: scarcity-beauty, scarcity-a good bargain, etc. For each combination the participant was asked to choose between one or both, in other words, which one he or she preferred.

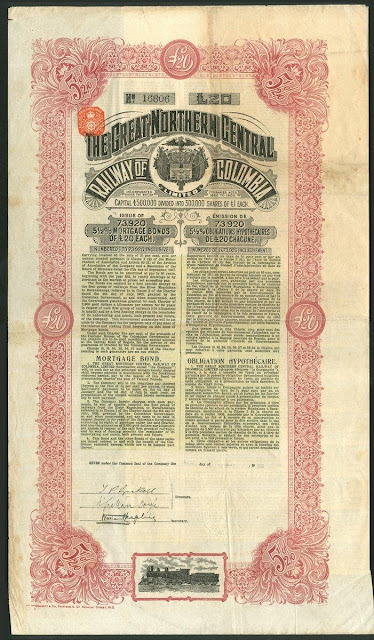

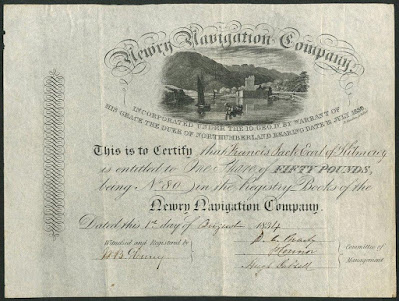

I leave it up to you to decide to which collecting motive the above share corresponds. The Ford Motor Company of Canada gained all Ford patent rights and selling privileges to all parts of the British Empire other than Great Britain and Ireland. Its share shows the company's sales markets in the British Empire on both hemispheres. It was issued in 1932. That year Adolf Hitler obtained German citizenship, the Kreuger & Toll business empire collapsed, the Dow Jones Industrial Average reached its lowest level of the Great Depression and Gandhi, in jail, began his first anti-untouchability fast.

I believed that the poll questions asked were relevant for banknote, coin, and stamp collectors as well. Thus, I promoted my poll also through the International Bond and Share Society (IBSS) and on a number of numismatic online audiences as well, such as CoinsWeekly, Numismatic Bibliomania Society’s E-Sylum newsletter, a IBNS discussion group, and several scripophily Facebook groups.

It took a few months, but all together 123 people cast their votes. In addition to questions on collecting motives, I started the poll with some general questions to have a better idea of the participants.

Though poll participation was anonymous, I asked about the participant's country. People responded from at least 20 countries. Top 3 locations were USA, 29%, Germany, 16% and UK, 11%. See the Poll Participants table for the details.

On the question Are you a member of a scripophily society? 41% replied they were not. But all 8 Belgian participants were members of a scripophily society, wonderful.

The next question queried the participants for their IBSS membership :

- 56% confirmed they were members.

- 28% said they were not and “didn’t care”.

- The remainder, 15% or 19 participants, replied they were not IBSS members but “wanted to find out more about IBSS”. In this category we find 2 Belgians, 3 Germans, 1 Indonesian, 1 Dutchman, 1 Filipino, 2 Poles, 1 UK citizen and 6 Americans.

On the question How long have you been a collector of scripophily?

- 82% said ‘5 years or more’. I'll call these group "the experienced" ones.

- 6% indicated they ‘did not collect scripophily’.

- 15 participants -12%- said ‘less than 5 years’. These are the "starters". Of the latter group, 5 were from the USA. Bravo!

Now what about the collecting motives? Which one is the absolute winner? Do we have the same results for the top 3 locations? Are there any differences between our "starters" and "the experienced" ? Let’s find out.

I used the following method to derive a ranking. For each one of the participants I counted how many times a motive was chosen in the participant’s comparisons. For example, if someone choose Beauty over Scarcity, then Beauty deserved one point, Scarcity zero. This led to 2460 scores : 123 participants * 10 pair comparisons * 2 motives.

And the winner is…

1 Collection Completeness, 332 points2 Historical Significance, 323 pts3 Scarcity, 260 pts4 Beauty, 159 pts5 A Good Bargain, 156 pts

The overall winner in the contest is Collection Completeness, closely followed by Historical Significance.

But the numbers also revealed that there are a two nuances.

- The group of the American respondents, 36 of them, however preferred Historical Significance above Collection Completeness.

- When we analyze the results by the number of years a person is collecting, only one motive prevailed. All 15 participants collecting less than 5 years - our "starters" - strongly preferred Historical Significance above all the other preferences.

Who are the tailenders ?

This might be a surprise but Beauty and A Good Bargain are apparently less important than the other ones when it comes to collecting motives. Even more, this finding applies to both our starters and the experienced.

This Ford Canada share may trigger one or more collecting motives. There is a lot to tell about. As you can see in this vignette, the Indian subcontinent is marked. One of Ford Canada's subsidiaries was Ford India Private Ltd where production began in 1926. An extraordinary Ford model was used by Mahatma Gandhi after he settled in Sevagram in 1936. There was no road to Sevagram and during rains people had to walk in knee-deep mud to the place, or use an ox cart to get there. The industrialist Jamnalal Bajaj, a close associate of Gandhi, arranged for a special vehicle to transport VIPs to Sevagram. It consisted of a sawn-off rear half of an old Ford car, drawn by oxen. They called it the 'Oxford'. In 1941 automobile magnate Henry Ford would write Gandhi a letter to tell him how much he admired Gandhi.

With this poll I did not reach collectors from South America, Africa and scripophily countries France, Russia, and China. It would be interesting to repeat the experiment on a future occasion and include a version in Spanish, French, Russian and Chinese.

My sincere thanks to all who participated and spread the word. I hope you found it as interesting as I did.

Happy New Year !

F.L.

Previous posts

- Unleash your detective skills with scripophily puzzle no. 4!

- Osakekirjat Kertovat, Finnish scripophily book review