Satire is a form of art that mocks wrongs, stupidities and faults in society thereby embarrassing individuals, organizations or society as a whole. Meant to be funny, satire creates useful social criticism.

In A Lesson in Greed: The South See Company Ursula Kampmann tells the story that is unfolded by a three-hundred-year-old Dutch engraving.

A Lesson in Greed: The South Sea Company

by Dr. Ursula Kampmann, Bookophile, Curator of the MoneyMuseum’s book collection

translated by Maike Meßmann

copyright Dr. Jürg Conzett of the MoneyMuseum

translated by Maike Meßmann

copyright Dr. Jürg Conzett of the MoneyMuseum

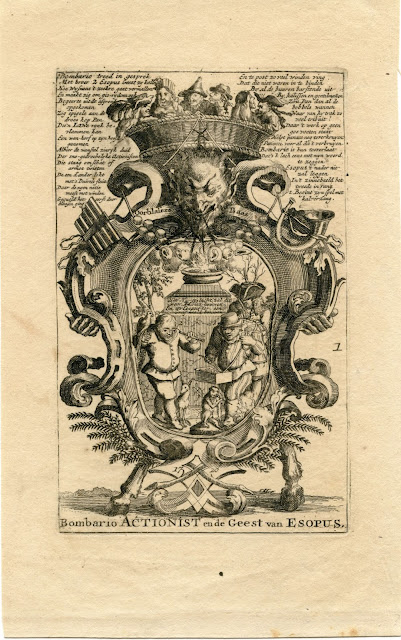

At the beginning of April, the Sunflower Foundation was able to purchase a satirical work for the MoneyMuseum’s book collection. The depiction of this copper engraving must be quite mysterious for anyone unfamiliar with the topic. It features a man with horns and cloven hoofs in front of a cartouche with a detailed drawing. In the centre of it there’s a tomb with a Dutch inscription: “Posterity will think of it as a fable and build a tomb in honour of Aesop.”

Satirical copper engraving on the financial crisis of 1720. Netherlands, 1720.

Cover page of a series of satirical engravings on the “South Sea Bubble”.

Contemporaries knew immediately what this was about: the spectacular collapse of the price of shares in the South Sea Company. And indeed, the South Sea bubble is still one of the financial crises that are referred to today when it comes to explaining how human greed and the government’s indifference can lead to high losses, and even to bankruptcy. Let’s take a look at what was happening, and let’s do it from the perspective of the caricature.

To the right of the tomb there’s a rich man wearing a curly wig signing a paper on the back of a hunchbacked, who is selling those papers from his vendor’s tray. The hunchbacked is identified as stock trader Bombario.

But what are these shares that Bombario is selling? Well, of course the most popular stocks of 1718, share certificates of the South Sea Company.

But what are these shares that Bombario is selling? Well, of course the most popular stocks of 1718, share certificates of the South Sea Company.

Sovereign Bonds, Shares or Lottery Tickets?

Actually, this South Sea Company was nothing but a variant of the Bank of England: first of all it raised an enormous amount of money that the country needed desperately. In return for the loan, the company was promised annual interest payments and the privilege of trading in South America. Hence its name, the oceans around South America were called the South Sea back then.

However, the plan didn’t work out. Attempts to stimulate trade failed; the government didn’t pay interest; and when a new war broke out in 1718, the experiment seemed to have failed for good.

But instead of giving up, the company lent the country money once more. In a complicated contract it was stipulated when which funds had to flow into the Treasury and when the government had to repay which sums. A good mathematician would have already been able to see back then that the company got less money back than it lent the government, but who pays attention to calculations when he’s hoping for a speculative profit?

This is what the artist wants to express by depicting hunchbacked Bombario: whoever touched a hunchback’s hump expected to get lucky. Signing a share certificate on the back of a hunchback was almost a guarantee for luck. And indeed, luck was needed even for getting back what one had paid for the certificate, as shares in the South Sea Company were actually nothing but lottery tickets or rather betting slips. Only those who got out of gambling in time were able make huge profits.

What those responsible for the South Sea Company did was a masterpiece of psychology and PR. The directors deliberately spread rumours about the company’s potential on the speculative market. They made sure that all magazines reported on the huge profits individual speculators had made with these shares. At the same time, they granted potential buyers instalments and loans in order to finance purchasing shares.

High members of the government were bribed with shares at special conditions that they could sell immediately for a high price – by the way, many of them didn’t do this, which is why they were among the losers, too.

Greed

Of course, everybody wanted to be part of this great business. Not only those who knew enough about economics to decide whether an investment was profitable or not bought participating certificates. No, also rich widows, ambitious students and solid businessmen, in short, everyone who had a few pounds left or was at least creditworthy invested. And they invested not only in shares in the South Sea Company.

Boom

At that time, there were many companies that messed with people’s greed. A colourful brochure, overblown promises, a rumour whispered in someone’s ear, and prices exploded. It didn’t matter whether a company was realistic, what mattered was whether there was someone to buy your share for a higher price. Not the project but speculation was the reason for profits. Obviously, there was a loser at the end of the chain. And because insiders were aware of this, they called this business model “bubble”: a beautifully shimmering appearance with no substance at all.

To protect consumers from such bubble companies, the government passed the Bubble Act in 1720. It determined that any new public company needed to be approved by royal charter. It was hoped that this would curtail at least the wildest excesses of bubble companies.

The South Sea Company had such a royal charter, which meant that every speculator expected that now – after so many other companies had disappeared from the market – the speculative frenzy would focus on the shares of the South Sea Company. And indeed, people bought and bought, and in the August of 1720, only a few month before this engraving was created, a share certificate of the South Sea Company reached with £1,000 about ten times its nominal value.

And that was it. Obviously the shares weren’t worth that much. If you wanted to be honest, they weren’t even worth the £150 one still had to pay for them at the end of September. The speculators had pushed up the share price with their greed and were now complaining that many of them had ruined themselves financially because the stock had fallen back to a reasonable price.

Our copper engraving comments on this by depicting Greek poet Aesop. Aesop was known for his fables, which used animals as protagonists to illustrate human weaknesses. It’s no surprise that there’s a parrot on Aesop’s shoulder. Such an animal parrots everything without thinking or evaluating the message. What a splendid picture for all the deceived shareholders who thought that the purchase of shares alone was a guarantee of profit.

Obviously, the damaged shareholders weren’t that reasonable. They demanded the government to punish the swindlers who had fooled them. And that’s why many of those who until recently had been considered clever men of honour had to stand trial: the directors of the South Sea Company were removed, many of their possessions were seized and share buyers were compensated. High politicians were deposed because they were found guilty of corruption.

Well, human stupidity could hardly be brought before the court. And only very few people understood the lesson of the South Sea bubble, namely that the real value of a share originates in the company and not in a potential speculative profit that can be made with it.

Ursula Kampmann

Related links

- The original article can be found here on Bookophile.

- Bookophile was conceived by Jürg Conzett and Ursula Kampmann. You can subscribe here to its newsletter.

Notes

1 The full name of the South Sea Company was The Governor and Company of the merchants of Great Britain, trading to the South Seas and other parts of America, and for the encouragement of the Fishery.

2 The South Sea Company was founded in 1711 as a public-private partnership to buy state debt. It obtained a monopoly (Asiento) to trade slaves from Africa in the Spanish colonies across the Atlantic. After the South Sea Bubble debacle, the company survived after recapitalization measures by the government and continued until 1853. In its last years it ended its trading activities and only served government debt.

3 Scripophily from the South Sea company is known. Now and then "New South-Sea Annuities" certificates appear at auctions. You can see several of these, including an Exchequer Bill from 1720, and some coins as well, at the online collections of the British Museum, see here.

4 Scripophily magazine, issue June 2000, features a full article, by Geoffrey L Grant, on the company showing a stock transfer certificate from 1715.

5 American auction house University Archives sold in their 6th May 2020 event a document for subscribing to shares in the South Sea Company, dated 1720. Signed by Isaac Newton himself, the lot realized $85,000 without premium.

F.L.