One of the highest auction sales in 2020 was a subscription for shares in the South Sea Company. Issued in 1720 the document was signed by one of the most influential scientists of all time Isaac Newton. It sold in the University Archives May 2020 auction for US$85,000 without premium. This in itself is a fantastic result, but it was eclipsed by an even more spectacular sale: Marcel Duchamp's Monte Carlo bond.

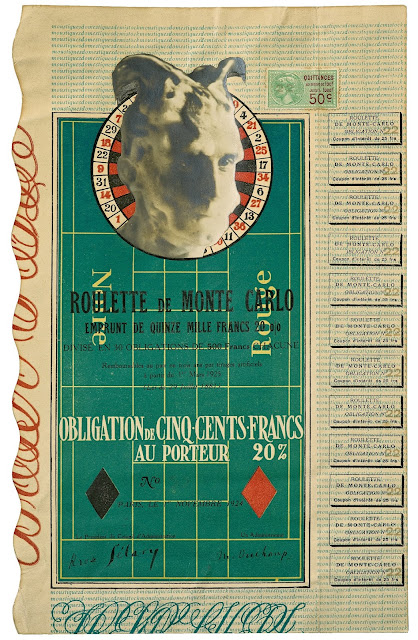

Sotheby's 4 February 2020 London sale featured this Roulette de Monte Carlo 500 Francs bond, number 22, dated 1924. The bond was issued and designed by Marcel Duchamp. It features a picture of himself made by American artist and close friend Man Ray. Duchamp's head is covered with shaving lather. His hair is peaked into two devilish horns.

Photograph courtesy of Private collection c/o Sotheby’s

Marcel Duchamp (1887-1968) is one of the most revolutionary and influential artists of the 20th century. He was born in Blainville-Crevon, a farming village in Normandy, France. His brother Gaston aka Jacques Villon became a famous painter. His sister Suzanne was also a painter, and his brother Raymond a sculptor.

Duchamp pioneered in the field of plastic arts, conceptual art and kinetic art. He introduced readymades, ordinary manufactured objects that he modified to combine creativity with criticism.

Fountain, one of his most discussed and controversial works, was a readymade of a porcelain urinal presented with an altered orientation. His Belle Haleine - Eau De Voilette, a readymade of a perfume bottle, created in 1921 with the help of Man Ray, sold at Christie's New York in Feb 2009 for $11,406,900.

Marcel Duchamp finished his Nude Descending a Staircase, No. 2 in 1912.

The painting is located at the Philadelphia Museum of Art.

Since childhood Duchamp's family introduced him to the game of chess. He became a good player and even wrote about chess. His fascination with the game distressed his first wife so much that at some point she glued his pieces to the chessboard.

Possibly the logic and mathematical concepts behind the chess game sparked his interest for the roulette game. Duchamp worked out a system which he could apply to the roulette tables of Monte Carlo. To finance increased wagers, Duchamp created bonds of 500 francs, repayable over a three-year period at 20% interest rate.

The artist planned to produce thirty of these bonds. Only eight, possibly less, bearing a legal stamp, were "issued" to some of his close friends as personal loans or as an early form of crowdlending certificates.

Upon further investigation you'll find out that there is something special going on with these certificates.

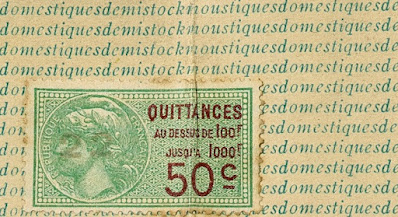

First of all, repeated in green ink in a continuous pattern in the underprint, you'll find a pun “moustiques domestiques demi-stock” (domestic mosquitoes half-stock).

Then, there is the interest rate of 20%. During the mid twenties, long term bond interest rates in France were about 6 to 8%. The one mentioned on the certificate must have been shocking.

Let's have a look at the signatures on the Monte Carlo bond. In its lower corners you'll find two signatures of company administrators, which is usually a legal requirement. The signature on the right is M[arcel] Duchamp's. The one on the left reads as Rrose Sélavy. Here we are dealing with the same person.

Rrose Sélavy was a Duchamp pseudonym. The name sounds like the French phrase Eros, c'est la vie. Sélavy emerged in 1921 in a series of photographs by Man Ray showing Duchamp dressed as a woman.

Here is one last oddity. Normally, on French securities we see a standard formalution like "Statuts déposés chez ..., notaire a", which means 'Articles of association filed with [name of person], notary at [name of location]'. Instead, we see the mentioning of a French law : Loi du 29 Juillet 1881.

The French Law of 29 July 1881, also known as the Law on the Freedom of the Press of 29 July 1881, defines the freedoms and responsibilities of the media and publishers in France. One of the most important reforms installed by the law was a major reduction in the extensive range of activities deemed slanderous.

As is the case with his other works, also here Duchamp challenges us and questions society, traditional art values and even his own productions.

In her 2004 essay Marcel Duchamp (1887–1968) Nan Rosenthal, art historian and back then curator at The Metropolitan Museum of Art, wrote :

By World War I, he had rejected the work of many of his fellow artists as “retinal” art, intended only to please the eye. Instead, Duchamp wanted, he said, “to put art back in the service of the mind.”

The Duchamp bond realized £495,000 including 20% buyer's premium.

F.L.

Reference

- Sotheby's Impressionist, Modern & Surrealist Art Evening Sale of 4 February 2020, London

- Sotheby's catalog: Impressionist, Modern & Surrealist Art Evening Sale, London, 4 February 2020

- Marcel Duchamp (1887–1968), Nan Rosenthal, Oct 2004

- Law on the Freedom of the Press of 29 July 1881

Previous posts