- International Bond and Share Society (IBSS), publisher of Scripophily magazine

- The Compagnie des Indes, by Howard Shakespeare, Journal of the IBSS, Feb 1997

- Swiss Finance Museum on the Compagnie des Indes Orientales

Tuesday, December 27, 2022

The most expensive share sold at auction in 2021

Sunday, December 11, 2022

Jigsaw Mayombe

Monday, November 14, 2022

Banks in Transition : From Counters to Apps

- All you need to know about your visit, see here

- The museum's blog

Thursday, October 27, 2022

Boone's 69th auction spans now 2 days. Among the stars are Ferdinand de Lesseps Suez Canal certificates and a 16th century loan from Antwerp.

- The Cuban Central Railways Ltd £100 debenture from 1899 shows two small vignettes and is rare, L544.

- Lots 806 through 828 includes several Panama Canal certificates.

- L887 shows a frontal view of a steamship on a Orinoco Steamship Company bond printed in 1902 by the International Bank Note Co. from New York.

- The Société de Recherches de Temascaltepec (Mexique) was organized to mine for silver in Temascaltepec. L1569

- members from the Rothschild banking family, L402 through 415,

- Paul Kruger, President of the South African Republic, L296

- L499 shows the signature of Robert Surcouf, the French slave trader and privateer who raided British ships

- A Nederlandsche Handel-Maatschappij share issued to the Dutch King Willem III, L441.

- bonds from the Flemish cities Antwerp, Aalst and Oudenaarde (L480, L482, L484)

- a 1759 share in the Compagnie Royale Prussienne de Bengale , L511

- whaling and canal companies, L486 & L514

- 18th & early 19th century French privateer companies, L489 through L499, and an American one, L533

- a collection of 108 French lotteries issued between 1699 and 1828, L501

- a put option certificate of the Bank of England as early as 1730, L516

An amazing discovery is L480, an Antwerp city bond for 100 Carolus Guilders from 1558. Issued on vellum, it has a large Antwerp city seal in red wax showing 'Het Steen', the still existing 13th century castle. The bond was part of a loan granted in 1555 by Charles V, Holy Roman Emperor and King of Spain.At the start of the 16th century Antwerp belonged to the Habsburg Netherlands, then part of the Holy Roman Empire. The city was a major shipping base for Spanish and Portuguese merchants importing sugar and raw produce from overseas. Antwerp became the main business centre around the Atlantic. Its wealthy bankers lended money to governments in Europe.Between 1555 and 1556, Charles V split his empire into an Austro-German and a Spanish branch. As a result of Charles's abdications, the Habsburg Netherlands were left to his son Philip II of Spain. Thus became Antwerp part of the Spanish Netherlands.During these decades war with France was never far away. Also the Catholic Church in the Spanish realm had to be defended against the upcoming Protestant Reformation. The loan was raised to finance the construction and maintenance of the fortifications of Antwerp, the so-called 'Spaanse omwalling' (Spanish ramparts). These were built on order of Charles V from 1542 onwards.€5000 is the start price for this top item that has witnessed a florishing but turbulent Flemish and Spanish 16th century.

- There is an opportunity to buy a Southern State Bonds Collection as a single lot (L649-L728). When there is no buyer then the collection will be regrouped by state, each one then offered as one group lot. In turn, these, when not sold, will be split into single item lots.

- US railways are plenty. You can find an interesting review on this chapter on Coxrail News and Announcements, see here

- Dates

- 5 November 2022, Antwerp Crowne Plaza Hotel

- International Bourse 8h30-12h

- Live auction 14h-18h30

- 6 November 2022, mailbid and online auction

- Further info :

Wednesday, September 21, 2022

Over 1500 lots of historic securities go on the block in FHW's upcoming sale, including an amazing share from Frederick the Great's Chinese trading company !

- The Central-Afrikanische Seeen-Gesellschaft operated gold mines and saltworks in the African Great Lakes region, then part of German East Africa. Seeen is German for lakes. This 1000 mark share was issued in Hamburg, 1902 and starts at €900, L384.

- The 1855 share from the Steinkohlenbau-Verein zu Rochlitz, a coal mine company, shows the city of Rochlitz, gnomes at work and an explosion in their mine, mined rock with imprints of fossilized plants and lots more. Extremely rare, this is in my opinion the most awesome German share certificate. L763, a top item, starts at €9,000.

- L926 starts at €320. The share from the Sundwiger Eisenhütte Maschinenbau-Actiengesellschaft displays a lovely Jugendstil design.

Four years after Frederick the Great became King in Prussia he annexed in 1744 the independent city-state of Embden (Emden), then the most important trade port on the North Sea. Eager to give Prussia a share of the Asian trade similar to the V.O.C. or the British East India Co., Frederick the Great granted the privilige in 1751 to found the Emden Trading Company.

The company, also known as the Königlich Preußische Asiatische Compagnie in Embden nach Canton und China (Royal Prussian Asiatic Company in Emden to Canton and China) was allowed to conclude contracts with foreign Asian rulers in the name of the King of Prussia. The Emden company owned four ships that made six voyages to Canton bringing back tea, porcelain and other goods.

The company operated independently - the king's main interest was filling the Prussian (war) treasury - and became the first modern German stock corporation, i.e. without state influence.

The share, L760 in the auction, issued in 1752 for 500 Reichsthaler in Friderichs d'Or is the oldest German share known.

It is also the oldest share in the German language. A complete translation of the text on the obverse, as well as a hint on its non-German provenance, can be found in the latest issue of Scripophily magazine, No. 119 August 2022.

The clipping shown here says [..the Company's ships which shall sail] to Canton in China as well as other places in India .. . The document must be the oldest known share mentioning the word China as well. Start price €50,000.

- L1429 is stock certificate in the Lamb's Run Oil Company coming from an old collection. Printed by Chandler from Philadelphia, 1865, it shows two vignettes of early oil derricks. The company was incorporated in Venango County, Pennsylvania where the biggest oilboom sparked only a few years earlier. €100

- Confederate States of America, 8% $100 bond from 1862, large vignette of the city of Richmond and portrait of C. G. Memminger, L1378, €300

- €380 may buy you a Laramie, Hahns Peak and Pacific Railway Company 100 common shares certificate issued in 1912. The company was incorporated in Wyoming. The shares of this company are illustrated with 3 vignettes of a locomotive, lumberjacks and miners at work, Cox cat nr LAR-083-S-51. L1430

- Date : 8 October, 2022

- Location : Wolfenbüttel

- Further info, see here; PDF catalog see there; live bidding is possible through https://connect.invaluable.com/dwa/

Monday, September 5, 2022

Puzzling scripophily - No. 7

- How to take part ? Submit your reply in the comments section of this post, or in any other way.

- What's in it for you ? The first correct answer yields eternal fame.

- When will the solution be revealed ? Check this particular blog post.

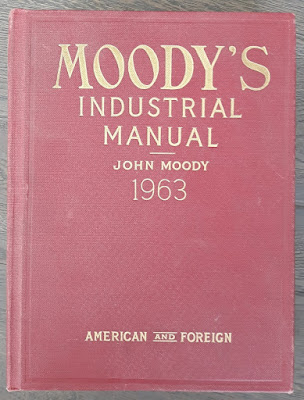

- Gigantic : Moody's Industrial Manual

- Collecting antique stock certificates ? Go to the next level with Scripophily magazine !

Monday, August 22, 2022

HWPH auctions Friedrich Wilhelm III scripophily, a VOC bond from the Dutch Golden Age and nearly 2000 lots of historic stock certificates.

Historisches Wertpapierhaus AG (HWPH) scheduled its next double-session sale for 3 and 4 September 2022. For this occasion specialist Matthias Schmitt and his team brought together some 2,000 lots of scripophily and related documents .

Included are several top-notch items such as a unique share from the Preussische See-Assecuranz-Compagnie issued to King Frederick William III of Prussia and one of the oldest securities from the mother of all joint stock companies, a Vereenigde Oostindische Compagnie bond from 1623.

The first leg of the auction is both a live and an online event and takes place in Zorneding, near Munich. The second part is an online only sale and happens the next day.

A major part of the offerings consists of antique bonds and shares from Germany, spread over several sections in both parts of the event. Among several German highlights you'll find these two :

- A radical democratic anti-monarchist, Gustave Struve's Gesellschaft deutscher Republikaner tried to finance the German revolutions of 1848-1849 with the issue of bonds. L515 is one of these rare certificates. Illustrated with several allegorical vignettes, it is propably the earliest known scripophily showing the colors of Germany's flag.

- AEG, worldwide known today for its eponymous home appliances brand, originated as the Deutsche Edison-Gesellschaft für angewandte Elektrizität. The auction features a 1883 share from this company, L538. The company changed its name change into Allgemeine Elektricitäts-Gesellschaft. L539 is a share, 1887, from the first issue using the new name. Both are extremely rare.

- Linhas Aereas Paulistas S.A. (LAP), Brazil map vignette, L68

- Lloyd Aereo Boliviano, L69, La Paz, aircraft vignette

- Badisch-Pfälzische Luft-Hansa A.G. Mannheim, L221

- Cathay Pacific Airways Limited, L734

- Japan Air Lines Company, Ltd., L770 and L771

Saturday, July 2, 2022

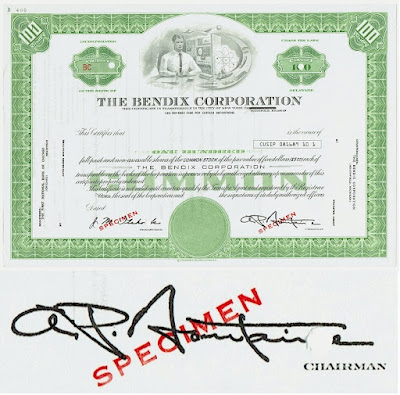

Gigantic : Moody's Industrial Manual

"Incorporated in 1929 as the Bendix Aviation Corp., the company adopted its present name in 1960. Bendix and its subsidiaries produce a wide line of aviation, automotive, missile, electronic, marine, space and automation products, .."

Athanas P. Fontaine (1905-1989) was a pioneering airplane designer. After graduating in aeronautical engineering, he helped designing the Aeronca C-1, the first lightweight passenger plane in the US. An aircraft designer and project engineer he worked for several aircraft companies such as Fairchild Aircraft Corp and Republic Aircraft Corp.A. P. Fontaine headed Bendix' aircraft division in 1944 but left in 1946 and returned in 1952 to become director of engineering. He was chairman and chief executive of Bendix from 1965 to 1972. source: The New York Times, May 17, 1989

Thursday, June 23, 2022

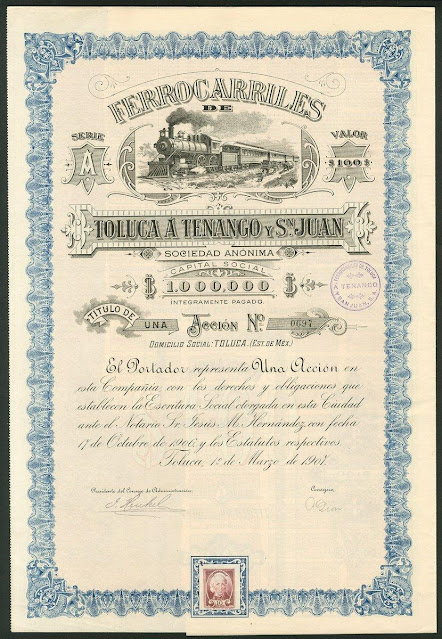

Spink's summer scripophily sale brings us to New Zealand, Mexico and beyond

- L5 is 5 shares certificate in The Railway Construction and General Development Company (Tasmania) from 1901.

- The Butcher's Reef North Gold Mining Company, Bear Hill, New South Wales, shares, 1889, bold red, purple and gold printing, L11

- The share from the South Australian Oil Wells Co shows a large vignette of an oil field. The company operated in Gippsland, Victoria, and reported test drills in the 1940s at a depth of over 4,000 feet. L29

- Railway enthusiasts will love the 1875 issued share in The Gorsedda Junction and Portmadoc Railways Company, Wales. Rare, L228 depicts a double-ended steam locomotive, a "double Fairlie".

- L290 contains lots of history: a share in The London Clinic and Nursing Home Ltd from 1929. The London Clinic is one of the UK's best private hospitals and has treated many famous names such as Charlie Chaplin. It was here that Chilean dictator General Augusto Pinochet was arrested in 1998.

- L264 consists of a group of three shares in the Associated Newspapers Ltd. Today known as DMG Media. This media holding publishes the Daily Mail, Metro, New Scientist, the Irish Daily Mail and many more.

- The Duquesne Incline Plane Co., Pittsburgh, PA, incorporated in 1876 with a capital of $40,000 consisting of 800 shares of $50. This certificate, from 1877, was issued for 20 shares. The company built a funicular on Mount Washington that ran at a grade of up to 30.5 degrees. L480

- Several $1000 6% Territory of Florida bonds from 1838, several vignettes, are offered. L360 through L368.

- L440 is a $5 Class B stock certificate in The North Carolina Gold Mining and Reduction Company, Philadelphia 1882, uncommon vignet of miners at work and railway bridge.

- Location : this is an Internet only sale

- Date : Jun 16 17:00 - Jul 5 11:00, 2022

- Further info : see here

Tuesday, June 14, 2022

Schweizer Finanzmuseum celebrates its 5th Anniversary

- 11 am - 12 pm: Combined tour (permanent and special exhibition), in German

- 12h30-1 pm: Guided tour through the special exhibition Sport & Geld, in German

- 1 pm -1h30 pm: Guided tour through the special exhibition Sport & Geld, in English

- 2 pm - 3 pm: Combined tour (permanent and special exhibition), in German

Sunday, June 5, 2022

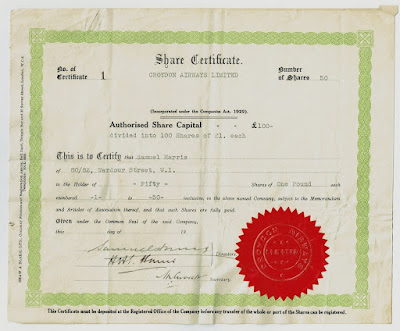

The smallest company in terms of equity capital, is it ?

Sunday, May 22, 2022

Collecting antique stock certificates ? Go to the next level with Scripophily magazine !

- Piers and Seaside Entertainment, interview with a collector

- Book review : Stamp Taxes in Nevada I. Silver Fever! Nevada Territory Stock Certificates, 1863-4, author Michael Mahler

- Book review : Michigan Copper Mining Stocks and Bonds, Part II, author Lee Degood

- El Partido Revolucionario Cubano, a rare but fake bond emerged

- The Insanity Spreads, NFT technology flirts with Scripophily

- Dispatches from the Front, Bits and Pieces, market concerns with the Russo-Ukrainian War

- The Greenawalt Donation : Interview with David Mihaly of the Huntington Library

- Charles V Bond with phenomenal Face Value emerges (Spain)

- Standing on the Shoulders of Giants, Terry Cox reflects on his US railway project coxrail.com

- The Howe Sound Co, copper mining in British Columbia

- Selling the Security, member contributions with share certificates promoting the business

- Studebaker, the family, stocks and bonds, and legacy

- Deutsche Bank Part I : The History of "Deutsche Bank AG"

- Boomtimes in the German Sugar Industry : 1850-1885

- The IBSS Directory brings you in contact with fellow collectors. Many of those are experts in their field, often share common interests with you, and possibly live nearby. The Directory contains members from more than 40 countries.

- Upcoming events : Learn which auctions, collector bourses and society meetings will take place.

- Locate dealers and auctioneers : The Membership Directory also contains a list of dealers and auctioneers with further contact details. Most auctioneers and dealers publish their catalogues either online or on paper.

- Access to the Experts : Being part of the International Bond and Share Society (IBSS) has provided me access to a network of experts in a variety of specialties related to the collection of Stocks and Bonds, always willing to led a hand and point me in the right direction.

- Access to all content on the IBSS website, including digital versions of previous issues of Scripophily magazine, the online forum, special theme galleries, and the like.

- Newsflashes on the website focus on hot topics that can't wait for the next issue of the magazine.

- Get extra credibility : being listed as a member is a good reference in any deals made remotely with parties previously unknown.